The future of invoice processing: AI automation and mandatory e-invoicing in Microsoft Dynamics 365 Finance and Operations (D365 FO)

Discover the power of Microsoft Dynamics 365: Our blog series provides you with detailed information and tips & tricks for optimizing your Microsoft Dynamics 365 solution.

At a time when digital transformation and legal requirements go hand in hand, CFOs and finance managers are faced with the challenge of not only optimizing their invoice processing processes, but also making them legally compliant. The integration of artificial intelligence (AI) in Microsoft Dynamics 365 offers an advanced solution to master these challenges.

The future of invoice processing: AI meets mandatory e-invoicing

The processing of incoming invoices has changed significantly as a result of digitalization. In particular, the integration of AI technologies in Microsoft Dynamics 365 enables companies to process their accounts payable invoices more efficiently and accurately, while at the same time meeting the legal requirements of the e-invoicing obligation. Microsoft Dynamics 365 Finance and Operations (D365 FO) offers a comprehensive solution that integrates both automation through AI and e-invoicing compliance.

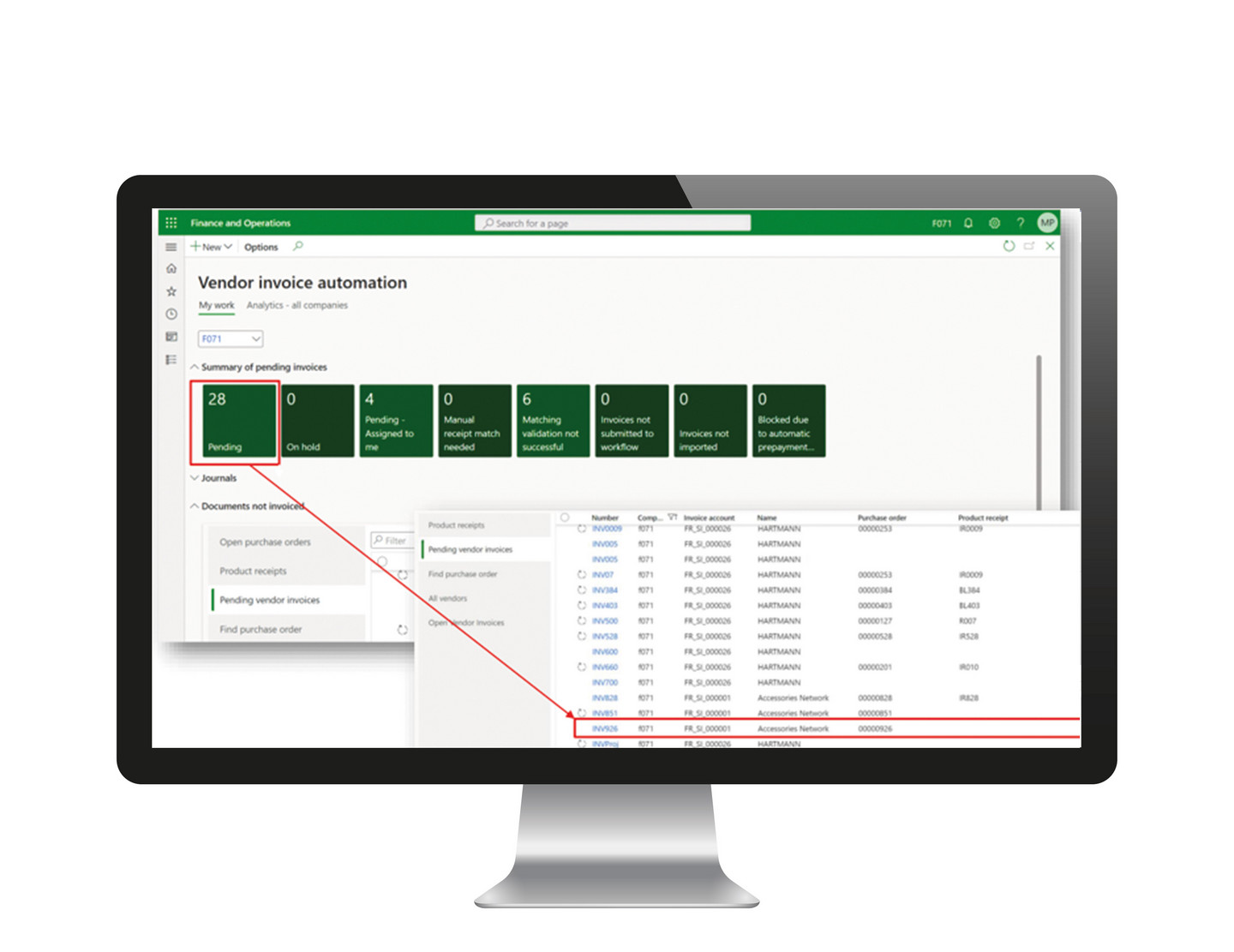

Microsoft Dynamics 365 Invoice Capture: efficiency through AI and automation

A particularly powerful tool in this context is the Microsoft Dynamics 365 Invoice Capture feature. This solution improves the efficiency and accuracy of incoming invoice capture through advanced artificial intelligence and automation technologies.

The steps and technical components of invoice capture in Microsoft Dynamics 365:

The process begins at invoice receipt, where documents are received via email, EDI, web forms or physical channels. The documents are then scanned and the data extracted using optical character recognition (OCR) technology to convert the relevant information into a structured format. The extracted data undergoes data validation and error correction, where anomalies are detected through machine learning and natural language processing (NLP) and either automatically corrected or flagged for manual review. After validation, the data is automatically imported into D365 FO to create the incoming invoice. Finally, the incoming invoice is posted, either manually checked or directly automated, depending on the configuration. This comprehensive technology and process integration enables precise, efficient and automated invoice processing.

Advantages of AI-supported invoice capturing with Microsoft Dynamics 365

- Faster financial statements

Monthly and annual financial statements are significantly accelerated by automated invoice processing and timely data provision. - Efficient clarification of open items

Automated processes enable open items to be identified and processed quickly. - Error avoidance and cost savings

Avoidance of duplicates and accelerated account assignment, reduction of manual errors and lower processing costs. - Optimization of cash discount utilization

The fast processing of invoices enables the utilization of cash discounts, which leads to cost savings. - Transparency and improved control

Centralization of invoice processes and prompt digital filing improve the overview and simplify the monitoring of approval workflows. - Increased ability to provide information

Structured and transparent documentation supports a better ability to provide information for financial and auditing purposes. - Automated data capture

Recognition and comparison of master data and automated checks for accuracy reduce manual intervention and ensure accuracy.

E-invoicing obligation: legal requirements and benefits

As digitalization progresses, electronic invoicing is becoming increasingly important. From January 1, 2025, companies in Germany will be obliged to receive electronic invoices in the B2B sector. From 2027, a further regulation will come into force that also stipulates the sending of electronic invoices. The aim of this change is to modernize the invoicing process and increase efficiency. Microsoft Dynamics 365 supports these requirements through the seamless integration of electronic invoice formats and processes. E-invoices can be generated and read. E-invoice formats such as XRechnung, ZugFeRD, PEPPOL and UBL are included as standard.

Advantages of mandatory e-invoicing

- Legal compliance: Ensure compliance with legal requirements and avoid penalties or delays.

- Increased efficiency: faster processing and handling of invoices improves liquidity planning.

- Cost savings: Fewer paper documents and manual entries reduce operating costs and administrative effort.

Conclusion

The AI-supported automation of invoice processing in Microsoft Dynamics 365 Finance and Operations is revolutionizing the way incoming invoices are captured and processed. By integrating OCR, NLP and ML technologies and meeting the e-invoicing obligation, companies can optimize their invoice processes, reduce costs and increase both customer and employee satisfaction. Use this advanced technology to make your invoice processing more efficient, accurate and compliant.

Would you like to find out more about this topic?

We can clarify your individual questions in a free consultation.

If you would like to find out more or have specific questions, we will be happy to help. Take the opportunity to arrange a free, no-obligation consultation with one of our experts.

In this meeting, we can discuss your individual requirements and give you a live demonstration of invoice capture in Dynamics 365.

Innovative features of Microsoft Dynamics 365

In addition to Invoice Capture, Microsoft Dynamics 365 offers a wide range of other functions that you can use to optimize your business processes. Experience the innovative features of Microsoft Dynamics 365 - the result of many years of project work with maximum added value for the life sciences and manufacturing industries.

Further topics relating to the optimization of your Dynamics 365 solution

Our partners

All partners