VAT ID check with Microsoft Dynamics 365 FSCM

Quick and easy:

VAT ID check with

Microsoft Dynamics 365 FSCM

Discover the power of Microsoft Dynamics 365: Our blog series provides you with detailed information and tips & tricks for optimizing your Microsoft Dynamics 365 solution.

What is the VAT check?

The VAT Check is a process in which the validity of the VAT ID number of a European business partner is checked. This is important to ensure that the tax requirements are fulfilled and to avoid possible cases of fraud.

Benefits of the integrated VAT check in Microsoft Dynamics 365 Finance and Supply Chain Management (FSCM)

1. Fast and intuitive: The framework integrates seamlessly into the existing Dynamics 365 FSCM user interface, enabling quick and easy integration into customer-specific processes.

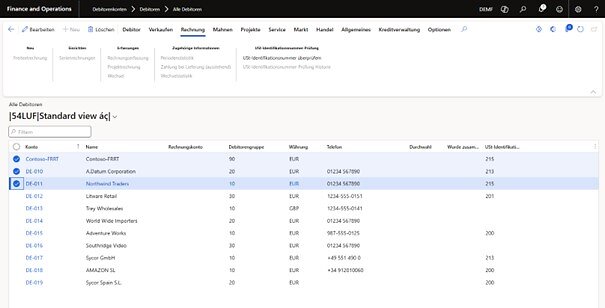

2. Uncomplicated validation: Once set up, individual or multiple VAT IDs of suppliers and customers can be easily validated.

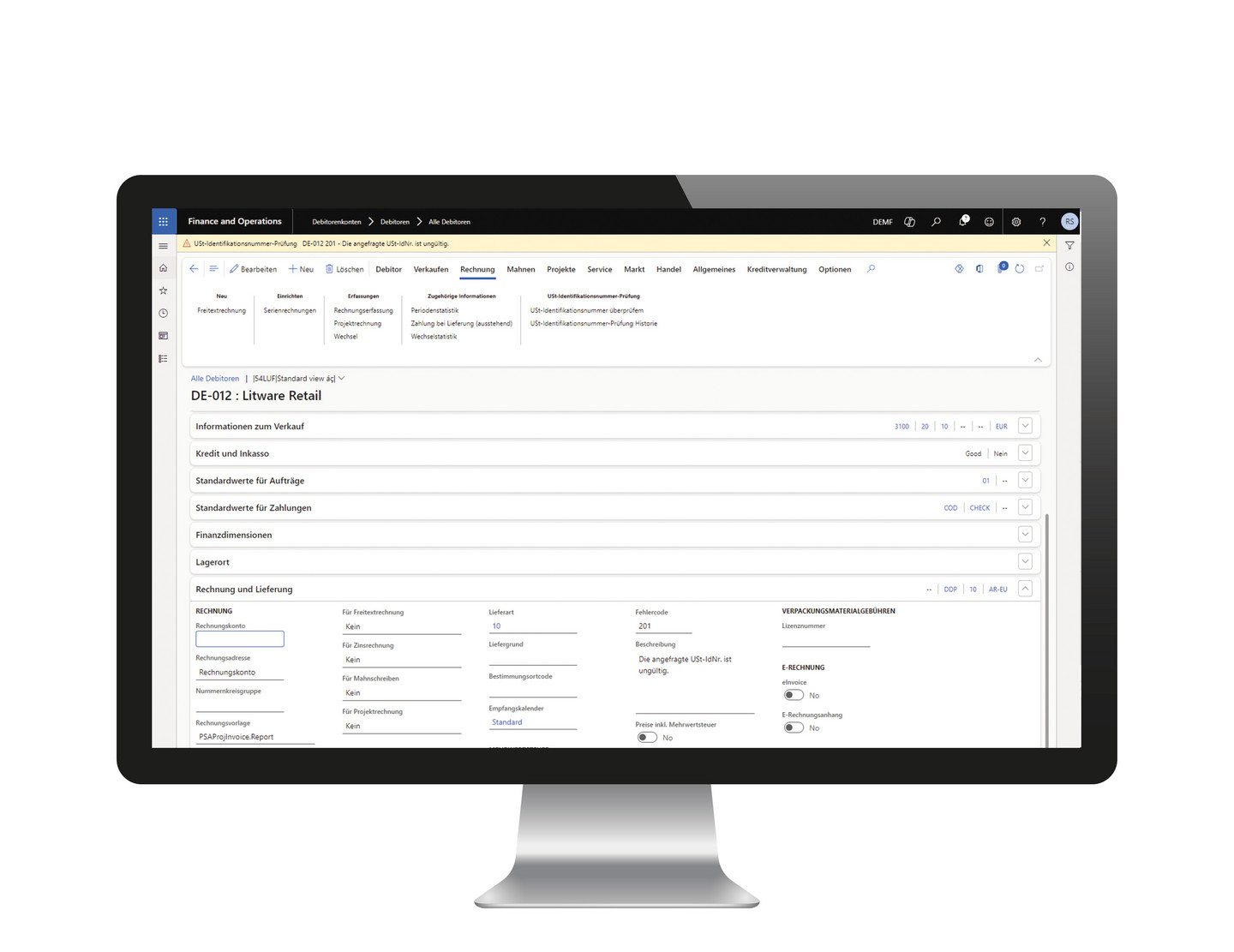

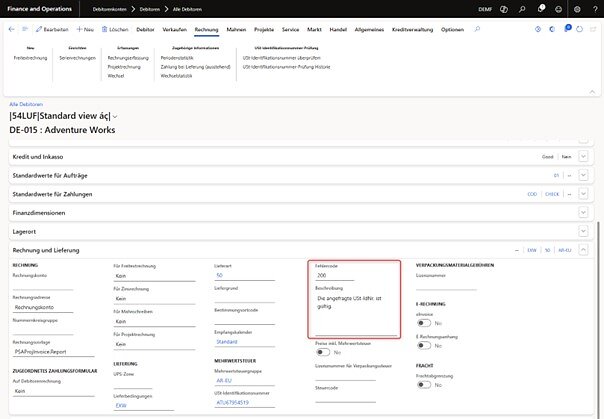

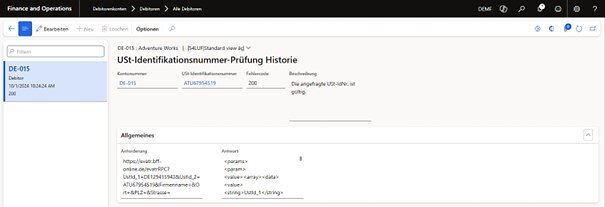

3. Automated check: With one click, the VAT ID is compared with the database of the Federal Central Tax Office (BZSt) and the result is saved in the master data.

4. Improved transparency and control: Dynamics 365 offers comprehensive control over the data to be checked and the feedback from the BZSt, making business relationships more transparent.

5. Error prevention and cost savings: The automated and mass check allows errors to be identified and corrected quickly, which reduces effort and costs.

6. Increased information capability: The integrated audit history makes it possible to trace at any time when which VAT ID was checked and with what result.

Legal background

The VAT identification number is a central element in the European internal market and is required for the cross-border movement of goods and services within the EU. The legal basis for the VAT ID check is based on the EU VAT Directive (Directive 2006/112/EC) and the national implementation laws of the member states. In Germany, the Value Added Tax Act (UStG) regulates the requirements for the VAT ID number and its verification. Companies are obliged to check the validity of their business partners' VAT ID numbers to ensure that they meet the requirements for tax-free intra-Community deliveries and services. Checking the VAT number helps to prevent tax fraud and ensure compliance with tax regulations.

FAQs

The VAT ID number is a unique identifier for companies within the EU that is used for the cross-border movement of goods and services.

Checking the VAT ID number is important to ensure that the tax requirements are complied with and to avoid possible cases of fraud. It is necessary for claiming the tax exemption for intra-Community deliveries.

Dynamics 365 automates the VAT ID number check by comparing the numbers with the database of the Federal Central Tax Office (BZSt). The result is saved in the master data.

The benefits include automation and efficiency, accuracy and compliance, real-time validation, integration with other modules, improved transparency and control, error prevention and cost savings, and increased information capability.

Correct configuration of the financial modules and integration of relevant data sources are required to implement the VAT ID check in Dynamics 365. The IT infrastructure must meet the requirements of Dynamics 365.

Would you like to find out more about this topic?

We can clarify your individual questions in a free consultation.

If you would like to find out more or have specific questions, we will be happy to help. Take the opportunity to arrange a free, no-obligation consultation with one of our experts.

In this meeting, we can discuss your individual requirements and give you a live demonstration of VAT check in Dynamics 365.

Innovative features of Microsoft Dynamics 365

In addition to the VAT check, Microsoft Dynamics 365 offers a wide range of other functions that you can use to optimize your business processes. Experience the innovative features of Microsoft Dynamics 365 - the result of many years of project work with maximum added value for the life sciences and manufacturing industries.

Further topics relating to the optimization of your Dynamics 365 solution

Our partners

All partners